Øystein Norgeng has published many books on international oil policy, particularly in relation to the Middle East. His book “Oil and Islam” has been translated into numerous languages.

In the summer of 2014, when Daesh (Islamic State) unexpectedly came to the fore in the Middle East, it was swiftly labeled as the richest terrorist organization in the world. Daesh was able to take advantage of a remarkable diversification of its sources of revenue: taxation, extortion, theft and oil. Taxation on the local population was the most important of these steps. At the time, the Iraqi Federal Government was transferring around $200 million per month to the civil servants in the regions occupied by Daesh. An income tax estimated at 50% was thus providing Daesh with more than $1 billion per annum. In exchange, Daesh refrained from attacking oil facilities in southern Iraq.

In the Middle East, oil finds its way to the market regardless of the borders and financial transactions.

Historically, the territories conquered by Daesh in the summer of 2014 had a limited oil extraction, never exceeding 300,000 b/d. At the time of Daesh’s victory, the volume was less than 100,000 b/d. After a year and a half, production fell further, to 10,000-40,000 b/d, fluctuating as a result of technical and personnel problems, defective services, bomb attacks and destruction, as well as complex rapports with rival tribes and political groups. During the summer of 2014, Daesh seized 4 to 5 million barrels of oil in storage facilities and oil pipelines in Iraq. Fearing possible reprisals, the Iraqi National Oil Company INOC continued to pump oil at the rate of around 150,000 b/d. Daesh had used INOC employees to pump nearly 30,000 b/d from the Ajeel field, sending the associated gas to Kirkuk, which is under the control of the Kurdish Regional Government (KRG). Oil that was stolen in Iraq was sold to Kurdish traders. Steps taken by the KRG against illicit traffic incited Daesh to intensify the conflict.

In the Middle East, oil finds its way to the market regardless of the borders and financial transactions often manage to cross the lines of political and military conflict. There has been a remarkable continuity of people and firms active in Iraqi oil smuggling since the 1990s. The surge in these smuggling operations was facilitated when the Iraqi armed forces were obliged by the American occupying forces to disband in 2003. Since the American invasion, illicit oil trade has been one of the driving forces of the Iraqi economy. In recent years, the civil war in Syria and Daesh’s advance into Western Iraq gave smugglers additional opportunities. Daesh sends natural gas by gasline to the thermal power plants under the control of the Syrian government, in return for electricity. Thus, in the Middle East, it is not unusual for military opponents to remain as trading partners. Part of the oil is refined in small, temporary units. Before exporting the crude oil and products, Daesh must give priority to the needs of its armed forces and the local population. As a result, the surplus of exportable oil has sharply decreased. Certain sources say that Daesh barely covers its oil needs, but that a surplus is created by theft and extortion. At the end of 2015, the oil production controlled by Daesh hovered between 15 and 45,000 b/d.

At the end of 2014, the volume reaching Turkey was estimated at 30,000 b/d, i.e. around 3.5% of the Turkish market.

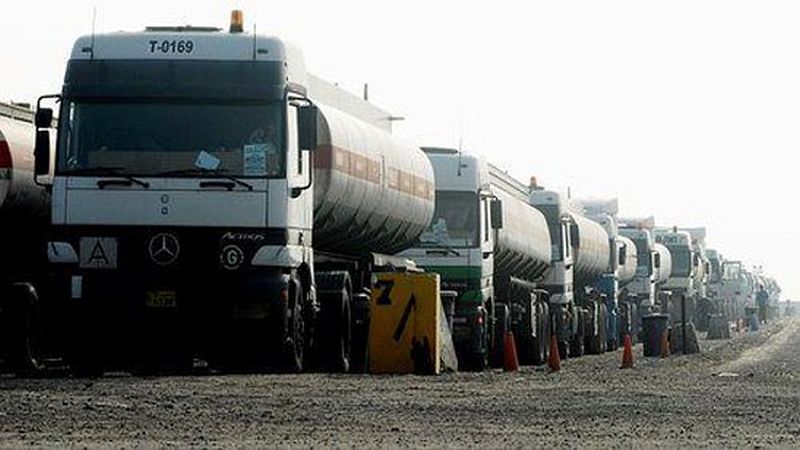

Daesh uses oil pipelines in Syria and Iraq, as well as the roads and smuggling networks of the entire region, a practice that goes back to the 1990s when the aim was to dodge the sanctions against Saddam Hussein’s regime in Iraq. These networks are often operated by former members of Saddam’s regime and the Jihadists. They have also been active in the smuggling of Kurdish oil in Iraq and Turkey. They have close ties with important businessmen and politicians in Turkey, as well as in Iraqi Kurdistan. The smugglers transport the oil mainly by trucks, but smaller volumes are transported by van or mule, improvised pipes, rafts when crossing rivers, etc… By cooperating with local tribes, Daesh strengthens its commercial and political ties.

Daesh’s oil is exported via Syria and Iraq, and sometimes to Jordan, Iran and Iraqi Kurdistan, although Turkey forms by far the biggest outlet. At the end of 2014, the volume reaching Turkey was estimated at 30,000 b/d, i.e. around 3.5% of the Turkish market. The main outlet was the province of Hatay. Trucks transporting Daesh’s oil were observed embarking on journeys of up to 10 hours into Turkish territory. Since the Syrian border zone with the Province of Hatay in Turkey is not under the control of Daesh, cargoes change hands to the North of Aleppo. Convoys of up to thirty trucks leave from the extraction sites, with the oil paid for mainly in cash. They prefer to pass through densely populated regions in order to discourage aerial attacks. Part of the oil even arrives at the Turkish Port of Ceyhan, from where it is distributed to global markets. In Ceyhan, Daesh’s oil is mixed with other cargoes. Certain volumes have reportedly reached the Israeli port of Ashdod, transported by oil pipeline to Eilat and then shipped by boat to Asia…

A good part of the oil crossing the Kurdish border is transited towards Iran, Afghanistan and the port of Bandar Abbas for reexport by boat, or even Southern Armenia. These volumes have been sharply reduced since 2014.

Transportation by truck has been complemented with temporary oil pipelines crossing the Turkish border. The Turkish customers include power plants, service stations and refineries, which benefit from discounted prices for Daesh’s crude oil. A good part of the oil crossing the Kurdish border is transited towards Iran, Afghanistan and the port of Bandar Abbas for reexport by boat, or even Southern Armenia. These volumes have been sharply reduced since 2014.

The prices obtained by Daesh are modest, probably 30 to 40% of the global market. Daesh does not organize the transport itself: these operations are outsourced to smugglers and professional transporters. Each truck carries around 250 barrels. Thus, a sale of 5,000 b/d would require 200 trucks. A truck could cost $400/d and the traffickers earn no more than around $1,000 per truck over 10 days, a meager profit given the risks at hand.

The coincidence of a sharp reduction in the production of crude oil and the fall in oil prices triggered a huge drop in Daesh’s oil revenues. It seems that at the end of 2014, Daesh managed to sell up to 60,000 b/d at $40- 45/b, i.e. revenues of $75 million/month. At the end of 2015, Daesh’s oil revenues are believed to have shrunk to $10 million per month, or even less.

Turkey’s role in Daesh’s growing influence is clear. The question is: to what extent Daesh’s dramatic breakthrough in 2014 would have been possible without Turkish consent?

In this context, the focus put on Daesh’s oil revenues seems exaggerated. Daesh has other sources of revenue, such as taxation, transit fees, extortion and theft. This also means that the bombing of oil facilities and infrastructure could prove very troublesome, as the aim is not only to deprive Daesh of money, but also of its political base. The Arab Sunni population of Western Iraq and Eastern Syria must therefore be given a perspective for its participation in its own future. Turkey’s role in Daesh’s growing influence is clear. The question is: to what extent Daesh’s dramatic breakthrough in 2014 would have been possible without Turkish consent? The open border enabled Daesh to import fighters, arms, money, while also allowing it to export oil. As a result, in many regards, Turkey is the key for Daesh. Private Turkish interests are intrinsically involved, which would be difficult without Ankara’s consent. Turkish individuals and firms own a large share of the trucks that transport the oil from Daesh. Many of Ceyhan’s financial transactions are managed by Turkish banks. Through the adoption of relatively simple steps, such as the closure of the border, Turkey could have caused Daesh some serious, perhaps fatal, setbacks. Turkey has many reasons to collaborate with Daesh. Firstly, its economy is benefiting from cheap oil; this applies particularly to the border province of Hatay. Another motive is the desire to topple the Assad regime from power in Syria. For Turkey, the nightmare scenario would be a Kurdish State along its southern border, even though unity between Iraqi and Syrian Kurds would be no easy feat to pull off. Such a state would have a solid economic base via its oil and gas resources and access, via an oil pipeline in Syria, to the Mediterranean. The Kurds’ continuity is broken by a small territory with a Turkoman majority, which is of crucial importance as a transit point between Turkey and the territory held by Daesh.

For Turkey, the current arrangement with an autonomous Kurdistan within a weak Iraqi federal state is an acceptable one. This region receives a lot of private Turkish investments and supplies a large volume of oil to Turkey. Moreover, it has a big natural gas potential. Iraqi Kurdistan currently depends on Turkish goodwill for its exports. For the KRG’s budget, the transportation of oil to the Mediterranean via Turkey is crucial. On the other hand, Ankara is in conflict with the Kurds of Syria, led by the PYD, which is allied with the PKK in Turkey.

Faced with the risk of Syria breaking up, it is in Turkey’s interests to hinder all Kurdish territorial continuity. The recent Turkish military incursions into Iraq, as well as into remote parts of Syria, are indicative of Turkey’s apprehensions. A Kurdish defeat of Daesh could also trigger a Turkish intervention.